Charitable Gift Annuity

You may be tired of living at the mercy of the fluctuating stock and real estate markets. A charitable gift annuity is a gift made to CSUSB that can provide you with a secure source of fixed payments for life.

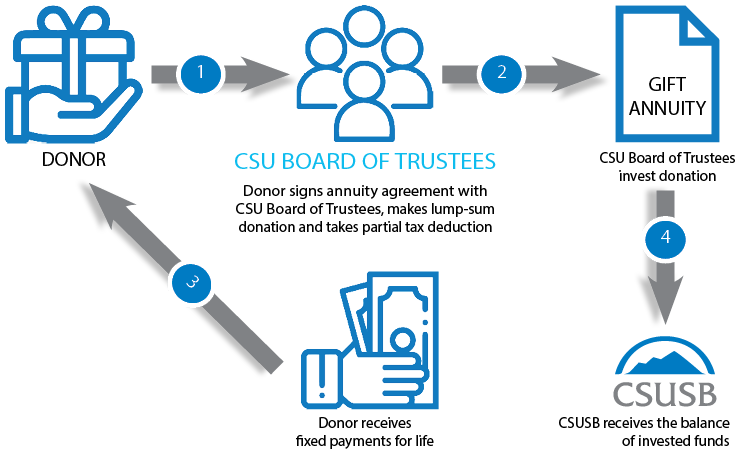

Flowchart:

Step 1: Donor signs annuity agreement with CSU Board of Trustees, makes lump-sum donation and takes partial tax reduction

Step 2: CSU Board of Trustees invest donation

Step 3: Donor receives fixed payments for life

Step 4: CSUSB receives the balance of invested funds

Benefits of a charitable gift annuity

- Receive fixed payments to you or another annuitant you designate for life

- Receive a charitable income tax deduction for the charitable gift portion of the annuity

- Benefit from payments that may be partially tax-free

- Further the mission of California State University, San Bernardino with your gift

How a charitable gift annuity works

A charitable gift annuity is a contract between you and California State University, San Bernardino.

- You make a gift of cash, stock, or other assets of at least $10,000 to California State University, San Bernardino

- In exchange, we sign an annuity contract and promise to pay fixed payments to you for life. The payment can be quite high depending on your age, and a portion of each payment may even be tax-free.

- You will receive a charitable income tax deduction for the gift portion of the annuity.

- You also receive satisfaction, knowing that you will be helping further our mission.

If you decide to fund your gift annuity with cash, a significant portion of the annuity payment will be tax-free. You may also make a gift of appreciated securities to fund a gift annuity and avoid a portion of the capital gains tax. Please contact us to inquire about other assets that you might be able to use to fund a charitable gift annuity.

Contact us

If you have any questions about charitable gift annuities, please contact us. We would be happy to assist you and answer your questions.

Additional Information

Current charitable gift annuity (payments begin within one year). With a current gift annuity, you may transfer cash or property in exchange for our promise to pay you fixed payments beginning as early as this year. You will receive an income tax charitable deduction this year for the value of your gift to California State University, San Bernardino.

Deferred charitable gift annuity (for payments at future date). Perhaps you are not ready to begin receiving payments until a future date, such as when you retire. With a deferred gift annuity, you establish the gift annuity today, receive a charitable income tax deduction this year, but defer the payments until a designated date sometime in the future. Best of all, because you deferred the payments, your annual payment will be higher when the payments start than they would have been with a current gift annuity.

Flexible deferred charitable gift annuity (gives you flexibility as to when the payments will start). With a flexible deferred gift annuity, you retain the flexibility to decide when the annuity will begin making payments. As with a deferred gift annuity, you establish the annuity today and receive a charitable deduction this year, but the payments are deferred until such time as you elect to begin receiving the payments.

Charitable Gift Annuity created with an IRA. The Legacy IRA Act passed at the end of 2022 created the option for donors over age 70 ½ to now be able to use a qualified charitable distribution (QCD) from their IRA to fund a charitable gift annuity (CGA). This new charitable planned giving opportunity could be an appealing and viable method for making an impactful gift that also creates added income and security for your retirement, all without using any discretionary income. Please note: this option is one-time only, up to $53,000 in a single year. Additionally, the entirety of the gift annuity payment(s) will be fully taxable, and there is no charitable deduction. Only the IRA owner and/or their spouse may receive payments from the CGA funded by the QCD; no payments are allowed to children or others. Please contact us for additional information.