Charitable Remainder Trust

You may be concerned about the high cost of capital gains tax with the sale of an appreciated asset. Perhaps you recently sold property and are looking for a way to save on taxes this year and plan for retirement. A charitable remainder trust might offer the solutions you need!

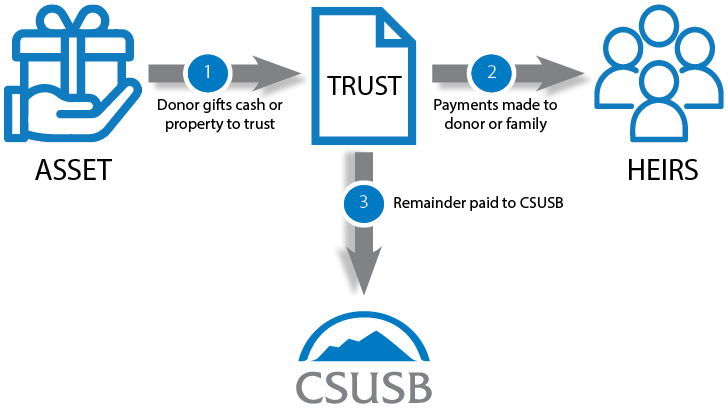

Flowchart:

Step 1: Donor gifts cash or property to trust

Step 2: Payments made to donor or family

Step 3: Remainder paid to CSUSB

Benefits of a charitable remainder trust

- Receive income for life, for a term of up to 20 years, or life plus a term of up to 20 years

- Avoid capital gains on the sale of your appreciated assets

- Receive an immediate charitable income tax deduction for the charitable portion of the trust

- Establish your legacy with a future gift to CSUSB

How a charitable remainder trust works

- You transfer cash or assets to fund a charitable remainder trust.

- In the case of a trust funded with appreciated assets, the trust will then sell the assets tax-free.

- The trust is invested to pay income to you or any other trust beneficiaries you select based on a life, lives, a term of up to 20 years, or a life plus a term of up to 20 years.

- You receive an income tax deduction in the year you transfer assets to the trust.

- CSUSB benefits from what remains in the trust after all the trust payments have been made.

Types of Charitable Remainder Trusts

There are 2 types of charitable remainder trusts based on how they pay beneficiaries. Both types of trusts can be made while the donor is alive or upon passing (testamentary).

Charitable Remainder Annuity Trust

A charitable remainder annuity trust pays a specific dollar amount each year. The amount is at least 5% and no more than 50% of the value of the property in the trust when the trust is established.

Charitable Remainder Unitrust

A charitable remainder unitrust pays a percentage of the value of the trust each year to noncharitable beneficiaries. The payments generally must equal at least 5% and no more than 50% of the fair market value of the assets, valued annually.

Contact us

If you have any questions about a charitable remainder trust, please contact us. We would be happy to assist you and answer any questions you might have.

Additional Information

Charitable remainder trust for income. A charitable remainder trust pays you income that reflects the value of the trust's assets. Your income has the potential to increase over time as the trust grows in value.

How to select the right trust payout. There are several trust payout options to meet your needs. The best payout option may depend on the nature of the asset used to fund the trust. We would be happy to work with you and your tax advisor to determine which payout option is best for you.