Life Insurance

A gift of your life insurance policy is an excellent way to make a gift to California State University, San Bernardino. If you have a life insurance policy that has outlasted its original purpose, consider making a gift of your insurance policy to California State University, San Bernardino. For example, you may have purchased a policy to provide for minor children and they are now financially independent adults.

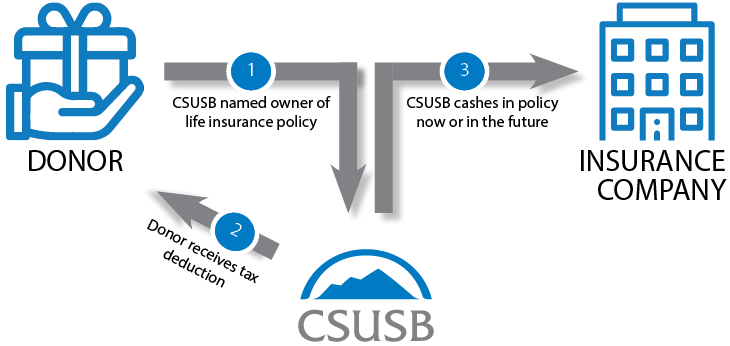

Flowchart:

Step 1: CSUSB named owner of life insurance property

Step 2: Donor receives tax deduction

Step 3: CSUSB cashes in policy now or in the future

Benefits of gifts of life insurance

- Receive a charitable income tax deduction

- Receive additional income tax deductions each year that you make additional contributions so that California State University, San Bernardino can pay the annual insurance premiums

- At death, the proceeds of your policy will be paid to CSUSB and we will use the insurance proceeds to continue to make an impact on the future

How to make a gift of life insurance

To make a gift of life insurance, please contact your life insurance provider, request a beneficiary designation form from the insurer and include California State University, San Bernardino as the beneficiary of your policy.

Contact us

If you have any questions about making a gift of a life insurance policy, please contact us. We would be happy to answer questions that you have.

Please let us know if you have already named us as a beneficiary of your life insurance policy. We would like to thank you and recognize you for your gift.

Additional Information

You can also designate California State University, San Bernardino as a partial, full or contingent beneficiary of your life insurance policy. You will continue to own and can make use of the policy during your lifetime. Your estate may benefit from an estate tax charitable deduction.

Your deduction for the gift of life insurance will depend on the whether the policy has increased in value above the premiums and whether the policy is paid up or there are remaining payments to be made.