Search For My Custodian:

| IRA web page | ||||||||

|

Notify us of your beneficiary designation gift

If you check the box in this area, a module will open where you can enter your name and email to notify us of your beneficiary designation gift.

|

||||||||

|

|

||||||||

|

Thank you for considering a beneficiary designation gift to us. The website link will take you to your retirement plan custodian's website, where you may be able to log in and include California State University, San Bernardino as a designated beneficiary. Another option is to use the phone number to call your retirement plan custodian. They will assist you in updating your beneficiary designation. If you would like to notify us of your generous beneficiary designation, please complete the Notify us of your Beneficiary Designation section.

|

||||||||

| Your Name | ||||||

| Your Address (Street or P.O. Box) | ||||||

| Your ZIP | ||||||

| Notify us of your IRA gift | ||||||

|

||||||

| Thank you for considering a IRA gift to us. A sample letter is available to send to your DAF provider. You may save and print the PDF of your letter. If you have email contact information for your DAF provider, you may send a PDF copy of your DAF letter or you may copy and paste the text into an email. You will need to enter the amount of your recommended grant and your DAF account number on the letter before mailing. If you would like to notify us of your generous gift, please complete the Notify us of your DAF Gift section. | ||||||

Beneficiary Designation Gifts

Future gifts from your retirement assets

If you are like many people, you probably will not use all of your retirement assets during your lifetime. Donating a portion or all of your unused retirement assets (referred to as a beneficiary designation gift), such as your IRA, 401(k), 403(b), pension, or other tax-deferred plan, is an excellent way to make a gift to California State University, San Bernardino.

Did you know that 40%-60% of your retirement assets may be taxed if you leave them to your heirs at your death? Another option is to leave your heirs assets that receive a step up in basis, such as real estate and stock, and give the retirement assets to California State University, San Bernardino. As a charity, we are not taxed upon receiving an IRA or other retirement plan assets. You can use the "Make a Future Gift of Retirement Assets" tool to contact your retirement plan custodian and designate a future gift to California State University, San Bernardino.

Benefits of beneficiary designation gifts

- Simplify your planning

- Support the causes that you care about

- Continue to use your account as long as you need to

- Heirs can receive tax-advantaged assets from the estate

- Receive potential estate tax savings from an estate tax deduction

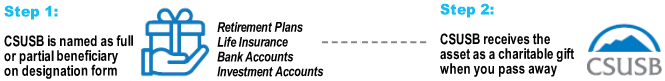

How to make a beneficiary designation gift

Flowchart:

Step 1: CSUSB is named as full or partial beneficiary on designation form

Step 2: CSUSB receives the assets as a charitable gift when you pass away

To designate Cal State San Bernardino as a beneficiary of any of the assets below, you will need to complete a beneficiary designation form provided by your account administrator. If you designate CSUSB as beneficiary, we will benefit from the full value of your gift because your retirement assets will not be taxed at your death. Your estate will benefit from an estate tax charitable deduction for the gift.

Wills, Revocable Living Trusts, Charitable Trusts, IRAs and Retirement Plans, Donor Advised Funds, Bank Accounts, Life Insurance, and Annuities

Legal Name: CSUSB Philanthropic Foundation

Address: 5500 University Parkway, San Bernardino, CA 92407

Federal Tax ID: #45-2255077

Contact us

If you have any questions about gifts of retirement assets, please contact us. We would be happy to assist you and answer any questions that you have.

Thank You

Your message has been sent.